Small cooperatives in Davao Oriental, unaffiliated with traditional banks, now have the opportunity to access credit without the burden of collateral and with minimal interest rates. This milestone achievement was realized through the recent acquisition of the Certificate of Registration for the Credit Surety Fund Cooperative by the provincial government.

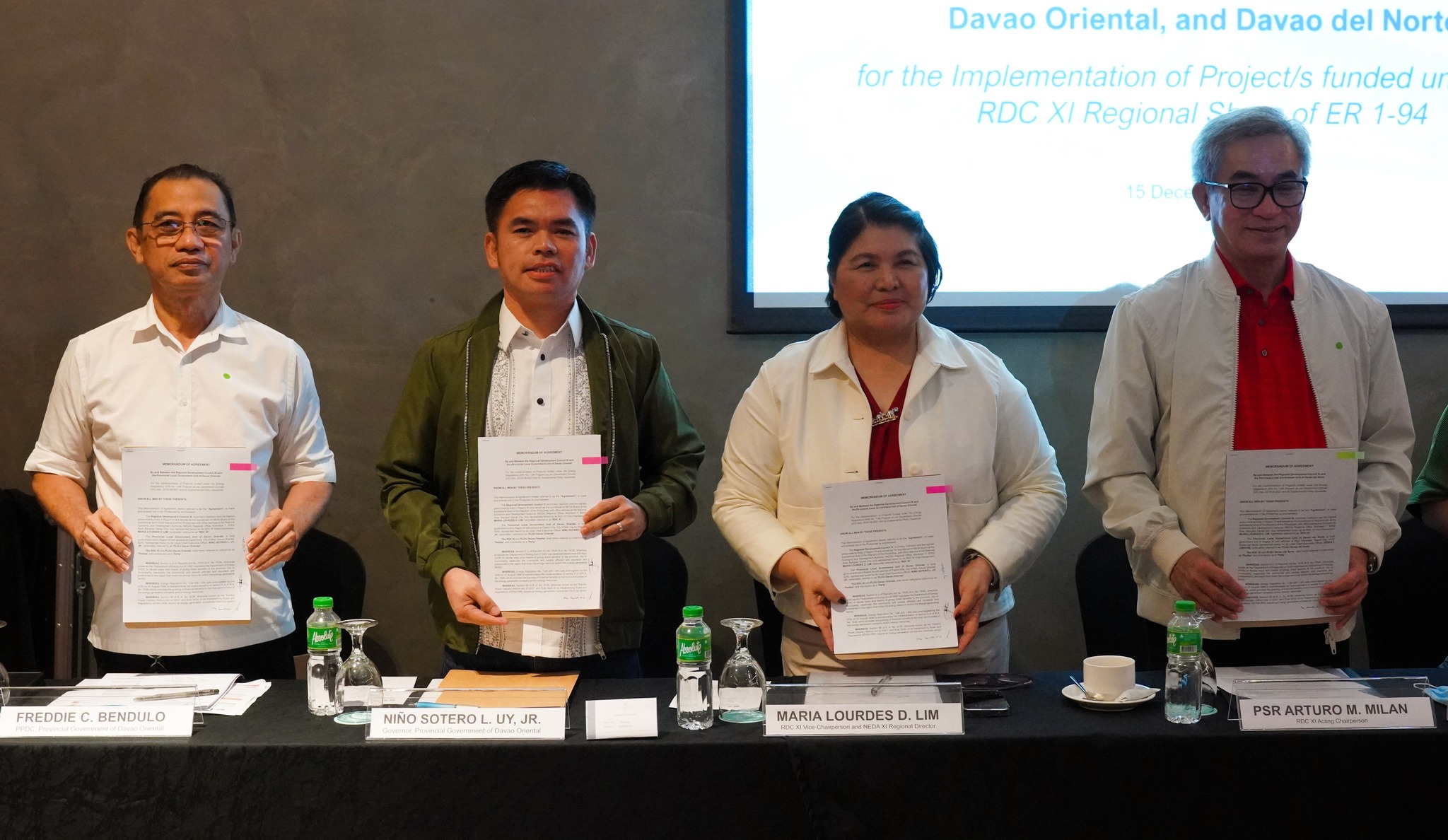

This significant milestone transpired during a turnover ceremony held at the Adelina Hotel and Suites in the City of Mati on January 18, 2024, marking a significant step forward for local economic empowerment.

Atty. Maria Lourdes Pacao, Deputy Administrator of the Cooperative Development Authority, emphasized the transformative impact of the Credit Surety Fund program. Through this initiative, small cooperatives gain financial access, even in the absence of a credit history, opening avenues for economic growth and sustainability.

The program is currently available to eleven registered cooperatives.

Demonstrating the provincial government’s commitment to fostering the growth of small enterprises. Governor Niño Uy has allocated a substantial sum of P1 million to the Davao Oriental Province Credit Surety Fund Cooperative, providing registered cooperatives with a valuable resource to kickstart and expand their businesses.

In addition to the Credit Surety Fund, the provincial government displayed further commitment by distributing livelihood checks totaling P500,000. Beneficiaries included the Women’s Multipurpose Cooperative (WMPC) receiving P250,000, Limot Mandaya Tribal Multipurpose Cooperative (LIMTRIMCO) with P100,000, San Luis Fisherfolk Association (SALUFIAS) obtaining P100,000, and individuals Rosalina L. Wagas and Analie D. Valeriano receiving P30,000 and P20,000, respectively.

The distinguished presence of CDA Undersecretary Joseph B. Encabo, Chairperson of the Cooperative Development Authority, added prestige to the event. Encabo applauded Davao Oriental for its dedication to empowering small cooperatives, emphasizing the broader positive impact on individual lives and community prosperity.

Encabo reminded Credit Surety Fund members of their responsibility to repay borrowed amounts, emphasizing the program’s dual benefit for both individual cooperatives and their surrounding communities.

Governor Niño Uy highlighted the program’s significance as a testament to the province’s commitment to grassroots economic development. Beyond strengthening the financial resilience of cooperatives, the initiative is a catalyst for local entrepreneurship, paving the way for sustainable growth and prosperity within the community.

Governor Uy, in his relatively brief tenure as the local chief executive, expressed unwavering dedication to improving the livelihoods of the people of Davao Oriental. He stressed the importance of tangible impact, noting that the success of any administration lies in the happiness of the people it serves.

Davao Oriental proudly stands as the 38th Credit Surety Fund Cooperative in the country, exemplifying its leadership in innovative approaches to local economic development. This milestone promises a brighter future for small cooperatives, promoting a cycle of prosperity that reaches every corner of the community. KLD-PIO | Photos by JB Rain